Economic Snapshot: A more positive month for markets

After the turmoil of previous months, markets took a more positive tone in July with both bonds and equities posting solid gains. A key driver of this was the view that the US Federal Reserve will slow the pace of interest rate hikes in coming months and move to cutting rates in 2023.

The Fed raised the cash rate by 0.75%, and the Reserve Bank of Australia and the European Central Bank both hiked by 0.5%. More rate increases are expected in coming months.The Bank of Japan remains an exception with ultra-easy monetary policy settings. The price of gold rose when US 10-year Treasury Inflation-Protected Securities (TIPS) yields fell sharply as the market priced lower US cash rates in 2023.

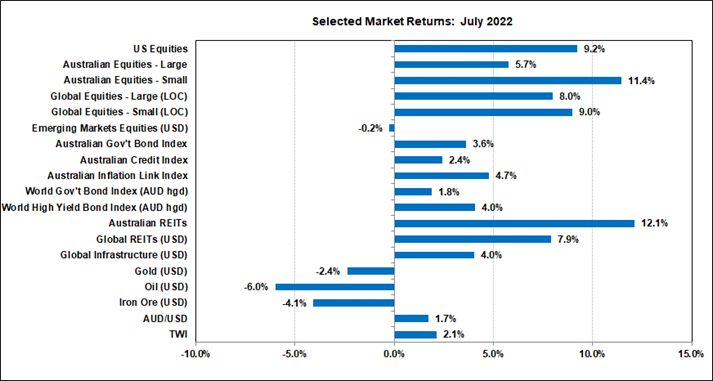

Chart 1: Bonds and equities bounced in July as markets revised down expected US cash rate hikes.

Source: Thomson Reuters, Bloomberg 1 August 2022

Key Developments in July 2022

After the turmoil of previous months, markets took a more positive tone in July with both bonds and equities posting solid gains. Some of the more ‘beaten down’ parts of the equity markets, such as domestic small caps and AREITs outperformed, but emerging market equities continued to languish.

There were two key drivers of the improved sentiment in July. The first was the view that the US Federal Reserve will slow the pace of interest rate hikes in coming months and move to cutting rates in 2023. The second was the US corporate profit results that, on the whole, came in better than expected.

USA

The backdrop to these developments in the US was further evidence that the economy is slowing down. Data released in July showed the ISM manufacturing and services indices both fell in June, although were still above the 50 level that separates growth from contraction. Consumer confidence fell further, and the labour market showed clear signs of softening demand for workers, although the unemployment rate remained steady at 3.6%. Real GDP growth fell modestly in the June quarter after a somewhat larger decline in the March quarter.

Some commentators seized on the “two quarters of negative growth means a recession” rule of thumb, but the bigger picture shows the US is not in recession. The National Bureau of Economic Research, which is the official arbiter of recessions in the US, uses a much wider array of data than just GDP to decide if the economy is in recession or not. The most important indicator is the unemployment rate: there is no recession without the unemployment rate clearly moving higher. This has not happened yet, but there is a general expectation the unemployment rate will rise in coming months, though just how far is still an open question.

Although headline US inflation rose to 9% in June, underlying inflation eased slightly to 5.9%, the price of oil fell by 7% to just under US$100/bl and supply chain indicators continued to signal softening inflationary pressures.

Interest rates

Markets took all this to mean the Fed is making progress towards its goal of taming inflation and that, as the economy slows into next year, the Fed will cut rates to mitigate the severity of any downturn.

At the end of the month, the Fed raised the cash rate by another 0.75% to 2.35%. The US cash rate is now very close to where it was before COVID hit and is expected to rise further in coming months. The markets seized on comments by Chair Powell in his post-meeting press conference in which he reiterated that the Fed would take interest rate decisions one meeting at a time, depending on how the data unfold, and that this might allow smaller hikes than 0.75% in future. The markets took this as validation of their views about where interest rates are heading, causing both bonds and equities to rally strongly.

The potential switch from Fed tightening to easing is known in the markets as “the Fed pivot”. Although markets bought this theme hard in July, many commentators, including some Fed Presidents, warned the markets not to get carried away. Powell had also reiterated the Fed’s views that the cash rate would be around 3.4% by end 2022 and 3.8% by end 2023. The markets are pricing close to the end-2022 figure, but a full 1% below the end-2023 figure. There is room for the markets to be disappointed.

Australia

The Reserve Bank also lifted the cash rate in June by 0.5% to 1.35%. Like the Fed, the RBA has said it will see how the data unfold each month before deciding on where interest rates are going. This is in contrast their policy last year of flagging potential stability of the cash rate until 2024. That policy is called “forward guidance” by the central bank. In the RBA’s case, the aim was to encourage expectations of a lower unemployment rates which could underpin stronger wages growth.

The surge of inflation caused by the Ukraine war in particular, has derailed that policy. The RBA has not been alone in this experience. Many central banks overseas have also used forward guidance until recently and are now moving away from it to focus on managing expectations about getting inflation under control. In this environment, the Federal Government has announced a three-member panel to conduct a review of the RBA’s approach on questions like these. The panel will report next year.

The pattern of our economy is similar to the US: consumer sentiment falling, a tight labour market (the unemployment rate fell to 3.5%) and high inflation (June quarter headline CPI was 6.1% and core inflation was 4.9%).

Europe

Elsewhere in the world, many countries are grappling with a mix of slowing growth and rising inflation. Parts of Europe, including Germany, look at risk of slipping into recession. The European Central Bank raised its cash rate from 0% to 0.5%, which was the first increase in 11 years. More hikes are expected in coming months. Inflation is running at 8.9% in Europe, driven heavily by energy price rises following Russia’s invasion of Ukraine.

China

Inflation continues to be a non-issue in China. Instead, growth is the problem as activity suffers from disruptions caused by COVID lockdowns. Indicators of both manufacturing and services activity remain choppy. Real GDP grew by only 0.4% in the June quarter and 5.5% growth target for this year looks increasingly unachievable. On top of this, problems in the housing sector caused by property developers have escalated.

Japan

Japan is also struggling to lift inflation and has maintained a low interest rate policy while other countries have been lifting their rates. This has contributed to major weakness in the Yen, especially against the US dollar. On the one hand the authorities in Japan are happy to have some weakness of the Yen because it allows them to import some inflation and helps boost the balance of trade. On the other hand, the Bank of Japan is starting to worry about speculative excess in the Yen’s decline.

Exchange rates

The US$ has been the world’s strong currency throughout 2022. This is partly because the US$ has a “safe-haven” appeal at times of global economic turmoil and partly because the Fed was raising rates while the ECB and Bank of Japan were doing nothing. This strength of the US$ has been a key reason why emerging markets have been underperforming so much. It is also why the A$/US$ has been weaker despite the RBA lifting the cash rate. The small rally in the A$/US$ in July reflects the markets’ views about the Fed pivot relative to the RBA hiking further in 2023.

The price of gold bounced off some key technical support level’s, helped by a sharp fall in US 10-year TIPS yields as the market priced in slower growth and lower cash rates in 2023.

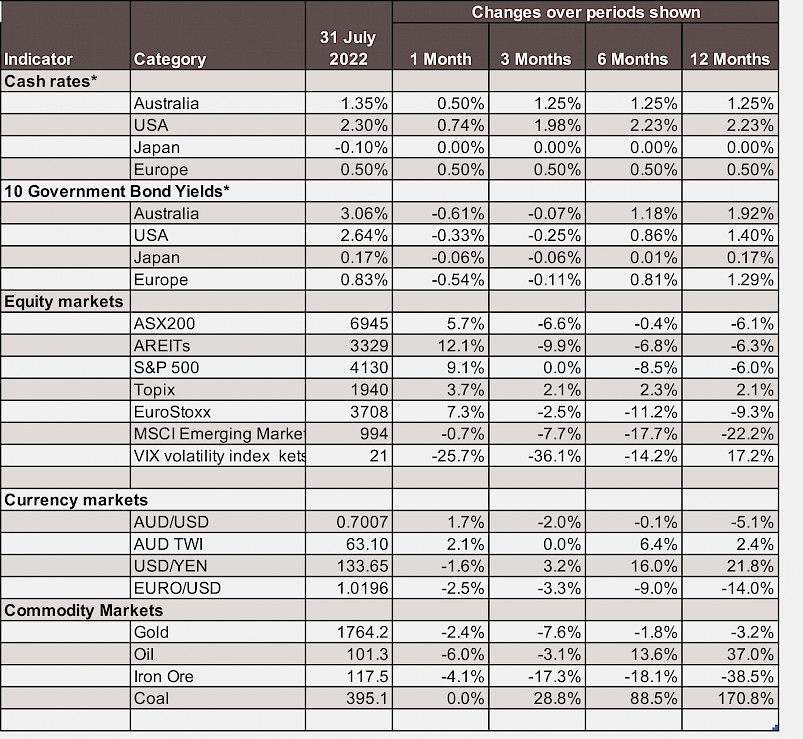

Chart 3: Major Market Indicators – June 2022

*For cash rates and bonds, the changes are percentage differences; for the rest of the table percentage changes are used.

Disclaimer: This document has been prepared for the FMD Financial Economic Snapshot by Caravel Consulting Services Pty Ltd [AFSL 320842] and is intended to be a general overview of the subject matter. The document is not intended to be comprehensive and should not be relied upon as such. We have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained in this document. Advice is required before any content can be applied at personal level. No responsibility is accepted by Caravel Consulting or its officers.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.