Economic Snapshot: Equities remain resilient

In a month characterised by shifting sentiments and global economic resilience, the Reserve Bank of Australia (RBA), at its second meeting for the year, opted to maintain the cash rate at 4.35%. RBA Governor Michele Bullock's indication of an open mind on interest rates signifies a shift in monetary policy.

Global equities continued their upward trajectory, buoyed by robust economic indicators and earnings, with a remarkable 3% rise in March and a quarterly gain of 14.1%, the strongest since 2013. Despite concerns over inflationary pressures, markets remained bullish.

In Australia, equities followed suit, albeit with a slightly tempered performance compared to global counterparts, registering a 3.3% increase for the month and a 5.3% gain for the quarter. Noteworthy sectors driving the local market included real estate (REITs), insurance, food and beverages, IT, and banks, showcasing diverse areas of growth.

In fixed interest markets, the US 10-year yield's climb to 4.3% signals a departure from expectations of imminent rate cuts. Australian bond yields mirrored the US upward trajectory, reaching 4.15% before settling at 4% by month-end.

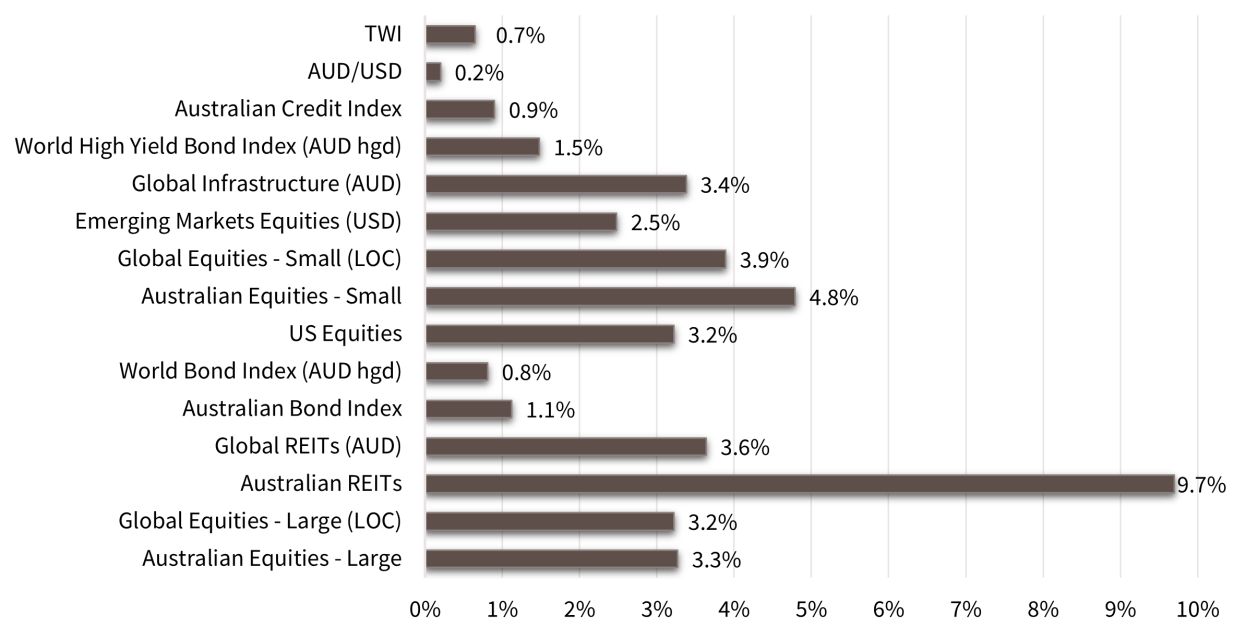

Asset Class Returns - March 2024

Source: Zenith Investment Partners Pty Ltd, Monthly Market Report, Issue 121, March 2024

Global Developed Equities

Global markets continued to rise in March, with a 3.2% increase, bringing most key market indices to record highs. This was supported by solid economic data and strong earnings growth. Inflation remaining higher-than-expected is causing expectations for a Fed rate cut to be pushed out to later in the year. Despite this, and a related rise in bond yields, equities remained strong.

Surprisingly, with a risk-on market mindset, the AUD declined 4.4% in the quarter, adding to unhedged international share returns. The MSCI World ex Australia index rose 3% in AUD terms. US corporate earnings have been better than expected, with earnings expectations for the first quarter declining less than usual. For the 2024 calendar year, earnings were revised down just 0.4% during the quarter.

Japanese equities were a standout with the TOPIX up more than 17% in the quarter and 38% for the year. However, in USD terms, the Japanese market was up by a slightly less impressive 11% (on the quarter). Various factors have supported this strength, including corporate governance reforms leading to companies seeking ways deploy excess capital for shareholders through buybacks, dividends, or acquisitions.

On the economic front, the US Institute of Supply Management (ISM) manufacturing index for March lifted above the important 50 level (more manufacturing companies with a positive outlook than a negative outlook) for the first time since October 2022. Overall economic growth for the December quarter, as measured by GDP, was revised up, to 3.4%.

Importantly, there is an evident slowing in US inflation data over the past two months, with inflation remaining higher than desired, leading to a change in rate cut expectations by the US Federal Reserve for 2024.

European activity appears to be stabilising, albeit at subdued levels, with the prospect of policy easing in the second half of 2024 still on the cards.

Looking at equity performance, in terms of sectors, more cyclical sectors performed well, with construction materials, banks, materials, and retailers showing gains. Energy also benefited from a jump in oil prices.

Australian Equities

Australian equities had a strong month, rising 3.3%, though they underperformed global developed markets for the quarter, gaining 5.3%. The ASX200 hit record highs in March, driven by gains in miners, REITs, energy, insurance, staples, and banks. Earnings outlook is improving, but consensus expect earnings per share (EPS) growth of around 3% from listed Australian companies.

For the quarter, REITs rose 16.8%, insurance 16.9%, food and beverages 20.5%, IT over 20%, and banks 11.9%. Materials were dragged down by weak iron ore prices, and food retailers also suffered in the face of negative media amid an impending Senate Inquiry in price inflation.

REITs rebounded after a decline in 2022-23, supported by signs of a peak in bond yields. Banks are at record highs due to a strong household sector, peak rates, strong offshore flows, and cautious investor positioning. Materials rebounded on signs of a bottoming Chinese economy in the face of lower bulk commodity prices.

The RBA kept cash rates at 4.35%, with commentary suggesting they’ll be data-driven while keeping an open-mind about their next move, that previously was more biased towards a cut. Recent economic data shows improvement, with employment rising, unemployment dropping to 3.7%, and house prices up 9% over the year.

The domestic economic outlook hinges on the household sector, which is expected to be more encouraging in 2024, supported by lower tax rates. Consumer and business sentiment remains low, but with more time and confidence that the RBA won’t tighten further, this trend should change as the year progresses; a rate increase from here could lead to a negative surprise for markets.

Emerging Markets

Emerging markets (EM) had a decent month, but Chinese equities struggled, continuing a trend seen in the past few months. The MSCI Emerging Markets index rose 2.3% in AUD terms, with EM Asia up 3%, led by Taiwan and Korea. For the quarter, EM in AUD terms gained 9.4%, led by Taiwan. However, the Chinese market fell 2.2% for the quarter.

Chinese economic data shows improvement, with the Caixin manufacturing PMI reaching a 13-month high. Retail sales rose 5.5%, and industrial production was up 7%. Emerging markets, though cheap compared to developed markets, need sustained higher growth and easing monetary policy for continued outperformance. Some countries, like Mexico, Brazil, and Hungary, cut interest rates, signalling stable domestic conditions.

Property and Infrastructure

REITs rose 9.7% in March, bringing the quarterly gain to 16.8% and the annual advance to 36.6%. Despite bond yields not driving REITs positively, investors are attracted by potentially lower interest rates later in the year and a better growth outlook, leading to investors being more confident that valuations will stabilise in the period ahead.

Global REITs rose 3.6% in the month but fell for the quarter. US real estate remains out of favour, with concerns regarding access to capital where the regional banks had previously provided funding to office, retail, and other property purchasers. With bond yields stabilising, a further catalyst may be needed to improve confidence that property values won’t weaken further from here.

The FTSE Global Infrastructure index rose 3.4% in March, but infrastructure has lagged due to rising real yields. With a return to more normal interest rates and economic conditions – after the volatility of COVID - infrastructure assets are performing soundly and fundamentals for these assets, like inflation-linked return streams, should lead to more consistent and stable future returns.

Fixed Interest – Global

Bond yields rose slightly in the month due to higher-than-expected inflation and Fed resistance to rate cuts. The US 10-year bond yield finished the quarter at 4.3% after starting the year around 3.95%.

The Bank of Japan increased rates and removed yield controls, the first time since 2016. This led to a higher 10-year yield and weaker yen.

Economic indicators in the US suggest improvements are being seen, with manufacturing and GDP growth showing strength. This supports a "higher for longer" scenario for the US cash rate, with markets expecting fewer rate cuts and the Fed funds rate to reach 4.7% by 2024 and 3.6% by 2026 (the current rate is 5.25-5.5%).

The broader, global fixed interest index - Barclays Global Aggregate index - returned 0.8% for the month but lost 0.3% for the quarter. US 10-year TIPs (inflation linked treasuries) yields rose to 1.96%, and corporate credit spreads suggest ongoing economic expansion. Global high yield credit returned 1.5% for the month and 11.5% for the year.

Fixed Interest – Australia

Australian bond yields rose to 4.15% but ended the month at 4%. The Bloomberg Composite bond index returned 1.1% for the month and 1.5% for the year. The RBA kept cash rates at 4.35%, with Governor Michele Bullock indicating a neutral stance on future rate moves. Economic data showed improved employment numbers and a drop in unemployment to 3.7%.

The NAB business survey indicated weak forward orders and subdued confidence, though actual business conditions were not as negative. Inflation remained steady at 3.4%, with core inflation slightly below 4%.

Commodities

Commodity markets rebounded in March, except for iron ore, which fell due to weak demand in China. Copper rose 4.1% on supply disruptions and strong demand, reaching over US$9000 per tonne. Brent crude increased 4% to US$87 a barrel due to tensions in the Middle East and rising demand from redirected ships.

Gold rose over 9% to US$2232.7 an ounce, driven by higher political risk and economic uncertainty, despite higher real yields. Central bank gold purchases are at five-decade highs.

Currencies

The USD strengthened due to strong growth and inflation data, leading to reduced rate cut expectations. The AUD traded around 65 cents.

Looking for personal financial advice?

This investment update is a general overview of market movements in March 2024. For personal financial advice to achieve your investment goals, contact your FMD adviser.

If you're new to FMD, but ready to get serious about planning your financial future or a worry-free retirement, book an initial discovery meeting with one of our financial advisers in Melbourne, Adelaide or Brisbane.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.