Rev Invest helping a new generation build wealth

Over the years we've met a lot of people early in their professional career, who want to invest to build wealth, but don't need our full advice service. Many of them have been the children or family and friends of our clients.

Often, they’ve met with an adviser and got some useful financial tips to set them on the right course, but until now, we haven’t had an investment service designed for their stage of life.

We recently launched our low-cost online investment offer, Rev Invest (revinvest.com.au), specifically to help the next generation build wealth, with the confidence of knowing a proven investment team is behind it.

The need for investment alternatives has never been greater

Forty years ago when my parents bought their first home, or even 20 years ago, when I bought mine, the answer to getting ahead financially in your 20’s and 30’s was fairly simple. Save for a deposit and get into the property market, invest your super wisely, work hard and watch your money grow.

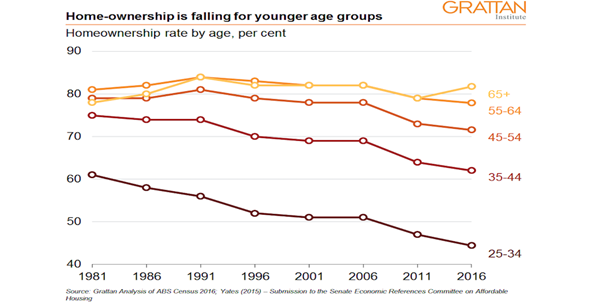

As the below chart starkly shows, this plan for building wealth is pretty much in the dust for people aged 25-35. Home ownership continues to become more challenging and is now at it’s lowest level since the ABS started recording this data in 1994.

Almost 60% of 25-35 year olds in Australia now rent, with just 40% being home owners.

This trend is likely to continue in the coming years, as a lack of affordable housing, strong investor demand and higher interest rates, inflation and HECS debts, combine to make it harder for young professionals - even those earning good salaries - to own a home or invest in property.

The problem with this trend is that, as we all know, one of the golden rules of building wealth is starting early enough to allow your returns to compound. So if the next generation isn’t investing in property, it’s crucial that they’re investing somewhere else to benefit from compounding wealth outside superannuation.

Otherwise it’s going to feel like they’re peddling hard and going backwards.

Online investing supported by the FMD Investment Committee (IC)

That’s exactly why we developed Rev Invest. People can open an account at revinvest.com.au with as little $5000 and invest in our tailored portfolios, managed by the FMD Investment Committee.

Rev Invest offers five different portfolios so people can choose the right level of risk and invest in what’s important to them. The reason we can offer access to these diverse portfolios at a low and transparent fee, is because we invest in a range of ETFs, or exchange traded funds.

The ETF market has grown significantly in recent years and offers a wide range of investment options. ETFs level the playing field and make quality investment products available to more people with smaller amounts to invest, which is exactly what Rev Invest is all about.

The other great benefit of Rev Invest is the ability to access invested funds whenever they’re needed. While it’s good to leave money invested for as long as possible for the best returns, it can be accessed within 48 hours, unlike a term deposit account, if you’re saving for a first home deposit, for example.

Watch this video where I interview Rev Invest's Model Portfolio manager, Jeremy McPhail, about the benefits of investing in ETF's and the different options on offer.

You’ll hear more about RevInvest throughout 2023 and our whole team is excited about helping the next generation build wealth and get ahead faster. In the meantime, as always, please reach out to your adviser if you have any questions about whether Rev Invest could be right for someone you know.

How to get started with Rev Invest

Visit revinvest.com.au to learn more and watch our video about how to get started. It only takes a few minutes to set up an account and start investing.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.