Tax and superannuation changes bring wealth building opportunities

It’s been hard to escape the news that the Federal Government has passed legislation to amend the controversial ‘Stage 3 tax cuts’ due to come in from 1 July this year. While there are bound to be mixed views about the nature of the changes, any tax saving offers new wealth building opportunities, from planning the timing of asset sales, to the potential to grow your super balance faster.

What’s changing?

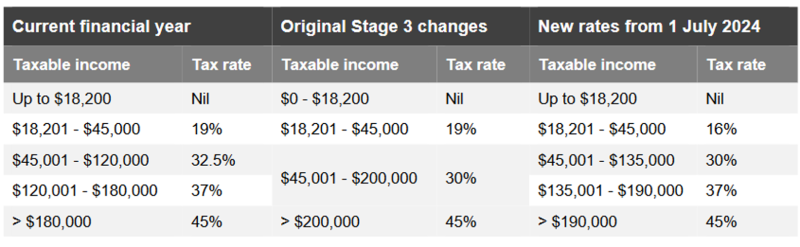

The Stage 3 tax cuts were already legislated by the previous Government and due to come into effect on 1 July 2024. Recent amendments change some of the personal income tax rates, as well as the income brackets that certain tax rates apply to. The tax-free threshold - the amount of income you can earn before tax is payable, will remain at $18,200.

Key changes from the original tax cuts:

- The 19% tax rate paid by lower income earners has been reduced to 16%

- The 37% tax bracket has been reinstated and now kicks in at $135,000

- The threshold above which the top tax rate of 45% applies had been decreased from $200,000 to $190,000.

The following table compares the tax rates for the current financial year with both the original stage 3 tax cuts and the new rates that come into effect from 1 July 2024.

How much will you save?

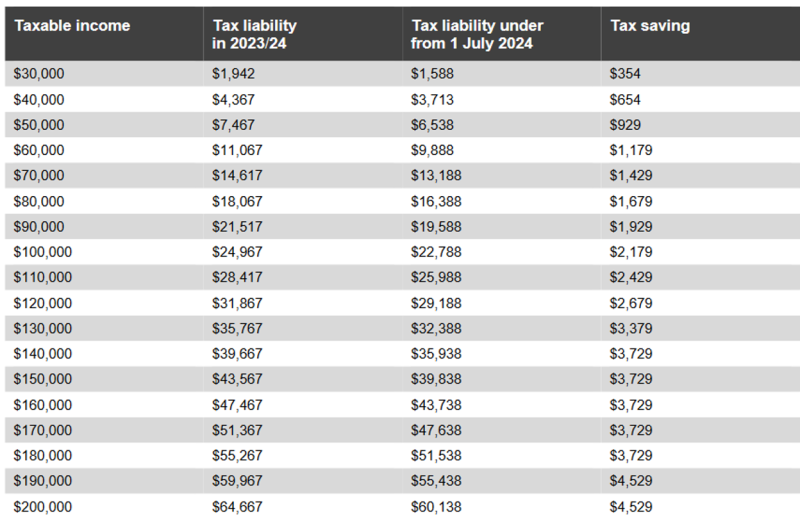

The below chart shows the tax savings that can be expected at different taxable income levels.

Employers will automatically adjust the amount of tax withheld from those payments from 1 July 2024.

*Source: Australian Government Factsheet: Tax cuts to help Australians with cost of living.**Calculations include the Low Income Tax Offset and 2% Medicare Levy

Changes to super contribution caps

The tax cuts will come into effect alongside changes to super contributions caps on 1 July 2024.

The concessional super contributions cap will rise from $27,500 to $30,000 p.a. and the non-concessional contributions cap will increase from $110,000 to $120,000.

How could you benefit from these changes?

Growing superannuation faster

The combined impact of these two changes will bring unique wealth building opportunities for different people.

The rise in the concessional contributions cap and the introduction of Stage 3 tax cuts from July 1, may combine to help young Australians grow their super faster and potentially, derive greater benefits from the First Home Super Saver Scheme (FHSSS).

Those closer to retirement or already retired, will have greater opportunities to grow their super through downsizing strategies or by contributing cash from tax cut savings, windfalls or investment returns.

FMD Adviser, Aakash Meta, discusses this opportunity in more detail in our latest Ask an Adviser video here.

Note: Consider the timing of contributions

If your marginal tax rate is going to decline in 2024/25 based on the newly legislated Stage 3 tax cuts, you may gain a greater benefit by making a personal deductible contribution before 30 June this year.

Conversely, if your marginal tax rate won’t change in 2024/25, the tax benefit from making a concessional contribution will be the same this financial year and next.

Reducing capital gains tax

For those thinking of selling assets that may attract a capital gain in the next 12 months, it’s worth considering the timing of any sale. If your marginal tax rate is going to be lower in 2024/25, you may pay less capital gains tax (CGT) by selling after 1 July this year.

Before you decide to defer any asset sale, consider whether the value of the asset is likely to decline and negate any tax benefit. Also factor in holding costs, such as rates or insurance in the case of property, for example.

Maximising the benefit of tax-deductible expenses

Changes to your marginal tax rate as a result of the upcoming tax cuts could mean there is a benefit in either bringing forward (or pre-paying) tax-deductible expenses or delaying them until after 1 July 2024. The sort of expenses worth considering include:

- premiums on an income protection policy held outside super

- interest on a fixed rate investment loan

- expenses for a rental property,

- work related subscriptions

To find out more about how upcoming changes to tax and super contribution caps could benefit you and your family, considering your personal circumstances, speak with your FMD Adviser.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.